The global financial system is the backbone of a modern economy as it enables the transfer of funds between individuals, businesses, and governments worldwide. Yet, the security and stability of financial systems, particularly those that depend on electronic payments and transactions, have come under scrutiny as cyberattacks have become more sophisticated.

One of the key components of banks is the SWIFT (Society for Worldwide Interbank Financial Telecommunication) network, which enables banks and other financial institutions to securely exchange financial messages and transfer funds across geographical borders. Nonetheless, given the sensitive nature of SWIFT transactions, very few banks’ branches conduct treasury-related transactions.

What’s the challenge?

One of the key challenges for most customers is to commute to those bank branches to get their work done. From a business perspective, it is crucial for the local branches to accept customer requests and conduct due diligence from the beginning. While some banks centralized the treasury business process and rolled it out to all their branch offices, compliance with RBI guidelines regarding SWIFT has been a challenge.

The RBI directed Indian banks to have separate networks for the SWIFT application and other business applications. That means bank users, especially those working in the treasury department, need two PCs — one for doing interbank global transactions using SWIFT applications and another for CBS and LAN applications, such as MS Office (Word/Excel/Outlook), etc.

Apart from increasing the end-user computing costs, the twin-PC policy negatively impacts the experience as well as the productivity of the users who are forced to constantly shuffle between their two computers. It also increases the possibility of human error while matching the data between CBS and SWIFT applications, posing the risk of financial and reputational losses.

Banks need a solution that will allow their users to carry out SWIFT & Core Banking Solution (CBS) operations from a single PC while complying with the RBI mandate.

As a compliance measure, the banks want to continue using biometric authentication for users to seamlessly access such applications and grant secure access to digital certificate-based applications. Another key requirement is to reduce management costs and ensure better maintenance of IT processes.

Here’s how Accops resolves the problem

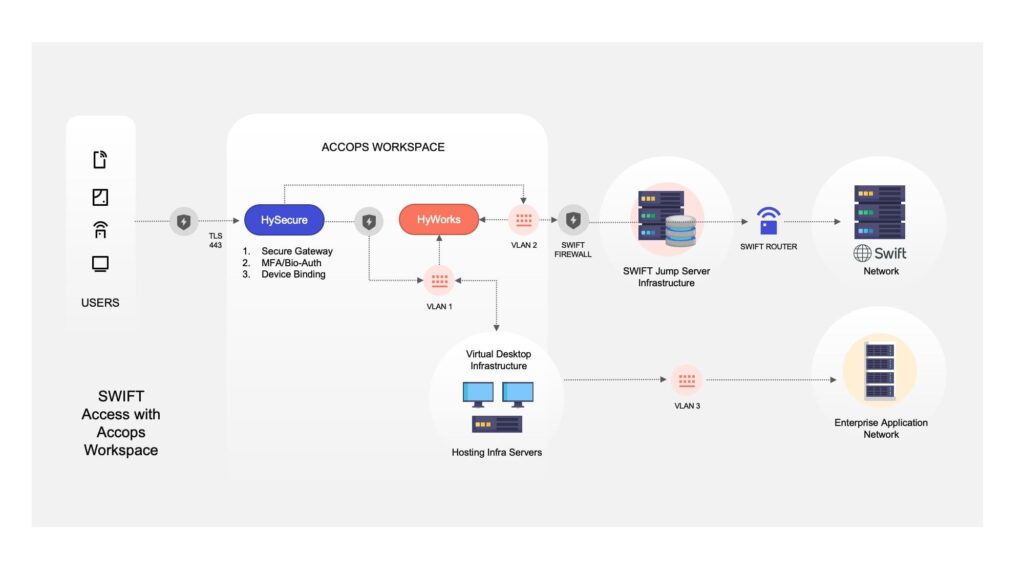

Accops provides jump server infrastructure using Digital Workspace. HySecure provides a secure gateway and reduces the attack surface by providing end-to-end encryption and exposing only TLS port 443 outside of the secure zone. This creates a secure and isolated enclave with controlled access. This customized solution not only protects a bank’s security framework but also powers up all treasury-related processes, including foreign exchange and other financial applications.

In such scenarios, here are some of Accops solutions which are deployed:

- HyWorks: Application and Desktop Virtualization

- HySecure: Zero Trust Application Access Gateway

- HyID: Identity & Access Management

- HyDesk: Thin Client Hardware

Attackers frequently advance an attack by moving laterally inside an environment using the privileges of a compromised account. By using MFA (multi-factor authentication), banks can add another layer of defense against common authentication assaults like shoulder surfing, password reuse, and compromised accounts. Accops’ zero-trust architecture enables context-aware security controls to prevent malicious hackers from accessing the network in the first place.

By implementing a unified solution, banks are not only boosting their users’ productivity by 10X but also scaling down the TCO by almost 50% with users using single devices for bulky transactions. The IT burden also reduces substantially with a significant reduction in storage requirements.

Wrapping up

No security control is completely foolproof. Hence, financial institutions must continually adapt and raise the bar for defense and secure their local environments to foster a safer financial ecosystem. With improved user experience, users can now use one endpoint to access both SWIFT & CBS applications and ensure better control in managing massive banking transactions.